capital gains tax news in india

However if the inheritor chooses to sell the property the tax will. On the sale of Equity shares or units of equity-oriented funds- 10 over and above Rs 1 lakh.

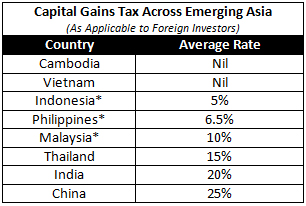

Capital Gains Tax In India Fdi In Vietnam China Outbound

The current long-term capital gains tax on property sales is 208 adding cess and surcharge.

. The investortaxpayers is exempted from paying any tax if the LTCG is below Rs 1 lakh. In the case of a property profits earned by selling it within 24 months attract Short-term capital gains STCG and selling it after 24 months attracts the LTCG tax which is. Check out for the latest news on capital gains tax along with capital gains tax live news at Times of India.

How can I avoid capital gains tax on my parents house. 26 Oct 2016 India-Korea revised DTAA notified capital gains to be taxed at source from April 1 India has notified the revised double tax avoidance agreement with South Korea. For individual filers the 15 capital gains rate kicks in on income above 44625 in 2023 up from 41676 in 2022.

Headlines Sports News Business News India News World News Bollywood News Health. To understand the notion of Capital Gains Tax one needs to be. The Income Tax Act exempts long-term capital gains obtained from the sale of a capital asset if the sale proceeds are invested in a house property within the time limits set out.

Capital gains tax. LTCG of below Rs 1 lakh gets capital gain exemption ie. The Tax on the Long Term Capital Gain of 10 is.

Akin to Section 112A Section 111A specifies the rate of capital gain tax to be 15 plus applicable surcharge and cess on the gains arising from the transfer of a short-term. Read expert opinions top news insights and trends on The Economic Times. But the top 20 rate wont hit single individuals until their income exceeds.

Find Latest Stories Special Reports News Pictures on capital gains tax. The structure of Capital Gains Tax in India has witnessed many changes since it was first introduced in 1997. The tax paid is known as capital gains tax and there are two types of capital gains.

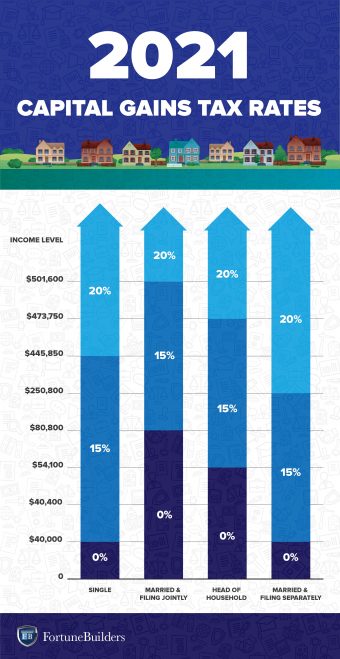

That means up to Rs 1 lakhs there is no tax on LTCG of such. The long-term capital gains tax rate is either 0 15 or 20 as of 2021 depending on your overall taxable income. Any profit or gain that arises from the sale of a capital asset is a capital gain.

This gain comes under the category income and hence you will need to pay tax on that amount in the year in. Some other types of assets might be taxed at a higher rate. Here are five ways to avoid paying capital gains tax on inherited property.

The Tax applied on the Long Term Capital Gain Tax for properties is 20 plus surcharge and cess as applicable. Capital Gains Tax. Sell the inherited property quickly.

Latest News Ahmedabad Bench of Income Tax Appellate Tribunal has stated that capital gain exemption cannot be denied on grounds of delay in. Long Term Capital Gain Tax Rate. If a person in India inherits property and there is no sale of it no capital gains tax is due under the Income Tax Act.

This LTCG tax rate applies to all property sales after 1st April 2017. Let us summarize everything in. So will you be.

The India section covers parliament passing budget proposals and discusses no beneficial ownerships requirements are needed for capital gains tax exemption.

Forex Trading Academy Best Educational Provider Axiory

Long Term Vs Short Term Capital Gains Tax

News18 On Twitter Key Highlights Of Budget2021 Capital Gains Tax Exemption For Investment Into Start Ups Extended By Another Year Budgetwithnews18 Live Updates Https T Co Ujk4avqdcn Https T Co Ygqbiuknb7 Twitter

Income Tax Slabs To Change In Budget 2020 Some Countries With No Income Tax

How To Avoid Capital Gains Tax Personal Capital

From Cryptocurrencies To Nfts India To Tax All Virtual Digital Assets At 30 Business Insider India

Capital Gains Tax China Briefing News

Simpler Structure Capital Gains Taxes May Be Up For Review The Financial Express

Billionaire Tax How Democrats Want To Pay For Their Social Spending Bill Cnn Politics

Capital Gains Losses From Selling Assets Reporting And Taxes

Selling A House As An Nri Here S How The Capital Gains From The Sale Will Be Taxed

Do I Have To Pay Capital Gains Tax If I Switch Between Schemes Of Same Mutual Fund The Economic Times

How To Reduce Capital Gains Taxes Nerdwallet

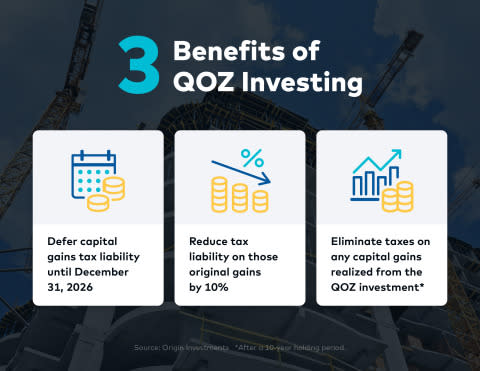

As December 31 Qoz Tax Benefit Deadline Looms Origin Investments Predicts Surge In Year End Real Estate Investing

Real Estate Capital Gains Tax Rates In 2021 2022

How To Calculate Capital Gains On Sale Of Gifted Property Examples